『ガチで16万稼げた!!!』

ド素人の僕がたった6日で16万ってヤバすぎません!?

当時は引っ越しのバイトしてて暇な時間に小遣い稼ぎたいな~って軽いノリでやってみただけなのに。

まじでこれ以上ない棚ぼたw

▼僕の愛車(ベンツのゲレンデ)

▼月1の海外旅行✈ inモナコ編

↑ルメリディアンホテルのスイート

▼最高の自己投資👍

中卒・陰キャで肉体労働のバイトしかしたことない僕が…

ノーリスクで安定して稼げる方法を知ったおかげであっさり人生逆転することができました!

> あなただからできたんでしょ?私は数々の副業に失敗してきたから自信ありません…

↓

こう思う人に自信を持って断言します。

絶対に誰でもできます!!それくらい再現性高い副業です。

内容をざっくりお伝えするとこんな特徴があります。

・パソコン不要

・特別な知識やスキル不要

・コミュ力不要…w

初心者でも安心してスタートできるから僕は興味を持ったんです。

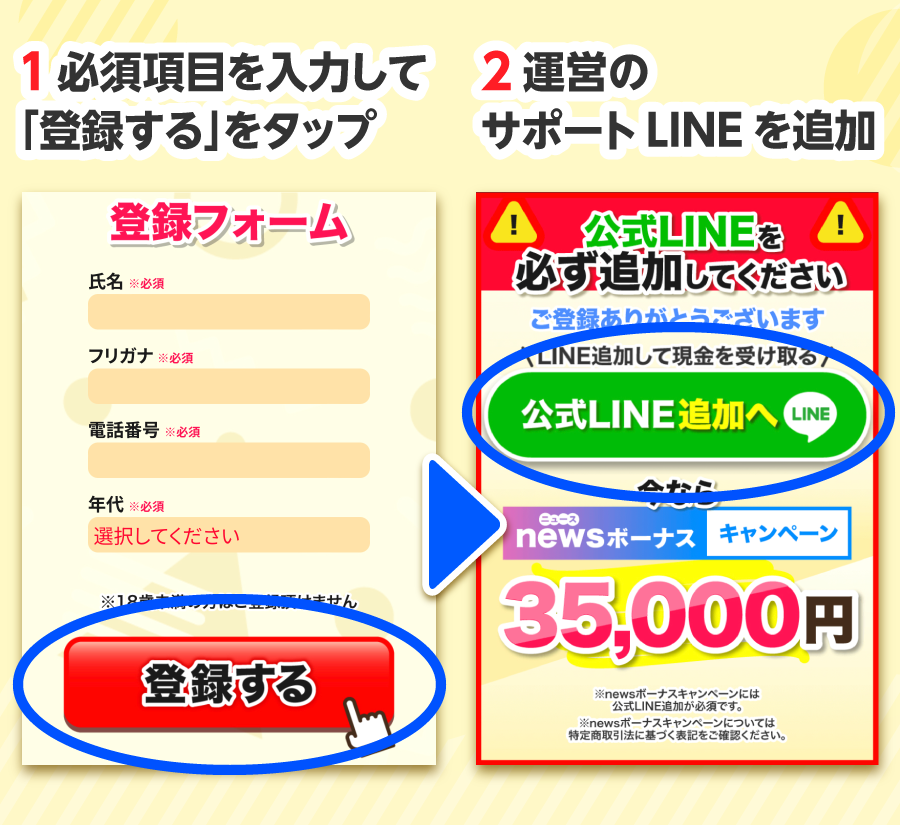

今参加できた人はレクチャー無料&35,000円のボーナスまでもらえるからめちゃラッキー

この時点でアナタが損をすることは一切なくなりました!

ただ当然ですが、枠には限りがあるので気になる人は下のボタンから先に進んでみてください。

--- 6/6追記 ---

枠が残りわずかになってるそうなのでお悩みの方はお早めに!!💨